Global Eyes on Aussie Rentals: What Overseas Search Trends Mean for Landlords in 2025

While many Australians are still adjusting to rising living costs and a tight rental market, overseas interest in Australian property is quietly building momentum. That’s good news for landlords.

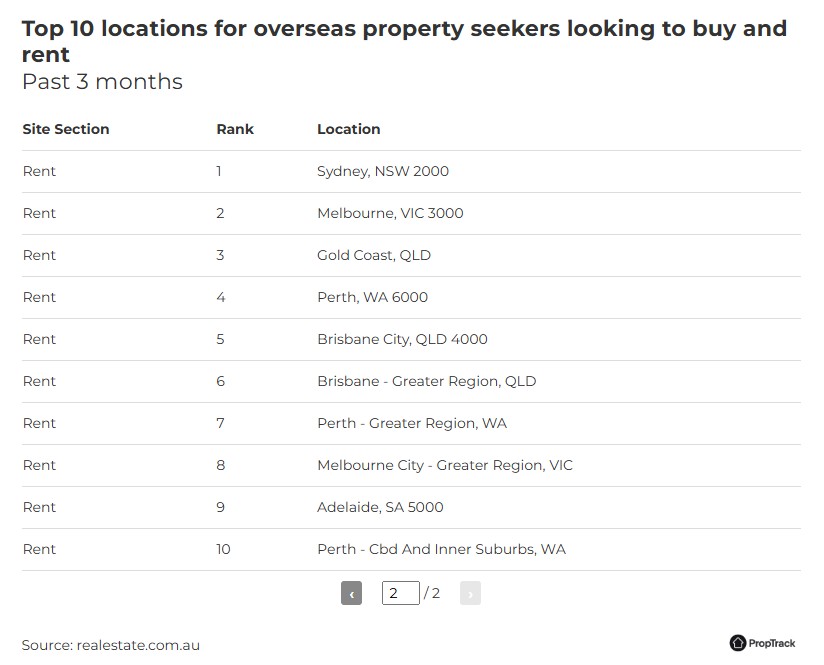

According to the PropTrack Overseas Search Report (November 2024), searches for Australian properties from international buyers and renters have increased compared to the same time last year. In some markets, the growth has been substantial, particularly from India, the United Kingdom, Hong Kong and the United States.

What makes this trend especially important for landlords is not just the volume of interest but also the type of renter it is attracting.

International Renters Bring Stronger Demand

- Searches from India were up 23% compared to last year, for both buying and renting

- UK-based searchers increased activity across both markets

- Hong Kong rental searches rose by 4%

- US-based interest surged in the past quarter, particularly from wealthier states like California, New York and New Jersey

These overseas searchers are often skilled migrants, expats, professionals or those relocating for work. They are not just browsing but actively considering relocation or investment, and many are looking for well-located, high-quality homes to rent.

Bigger Budgets, Higher Expectations

One of the most notable trends is the difference in budget. The most common price ceiling for Australian property seekers is $600,000. In contrast, overseas searchers are most often looking at properties priced around $1 million or more. This reflects their interest in higher- end suburbs such as South Yarra, Brighton, Camberwell, Bondi and Manly, where rental demand and yields are strong.

Even in cities with more moderate pricing, such as Brisbane, Perth and Adelaide, overseas demand is growing. These renters are drawn to lifestyle, convenience and new developments offering modern features and low maintenance.

Why It Matters for Landlords

This rise in international attention is promising for rental property owners. It suggests a larger pool of potential tenants, reduced vacancy periods and stronger competition for well-

maintained homes. Many international renters also have higher budgets and are willing to pay more for quality, location and lifestyle.

Favourable exchange rates and high property values in cities like Hong Kong and Singapore give many overseas movers more equity and purchasing power. For landlords, this means an opportunity to attract long-term, financially stable tenants who value premium properties.

With overseas migration picking up and Australia’s property market remaining resilient, landlords have a unique chance to benefit from global interest. Well-presented properties, especially those in desirable suburbs, are in demand and will continue to outperform.

Key Takeaways for Landlords

- Increased demand means more potential tenants and fewer vacancy periods

- Higher rent potential from renters who often have greater spending power

- Stronger interest in premium suburbs such as Bondi, Manly and South Yarra

- Modern, low-maintenance properties are highly sought after

- Exchange rates and equity from overseas markets make Australian rentals attractive

If your property is not currently positioned to take advantage of this trend, now is the time to review your rental strategy, refresh your marketing and ensure your rent is in line with current demand.

Want help maximising your rental property’s performance in 2025?

Contact Club Property Management at leasing@clubpropertymanagement.com.au to

make the most of the growing international interest in the Australian market.